The Chairman’s View: Leveraging 2026 Industrial Milestones for Strategic Exit Planning

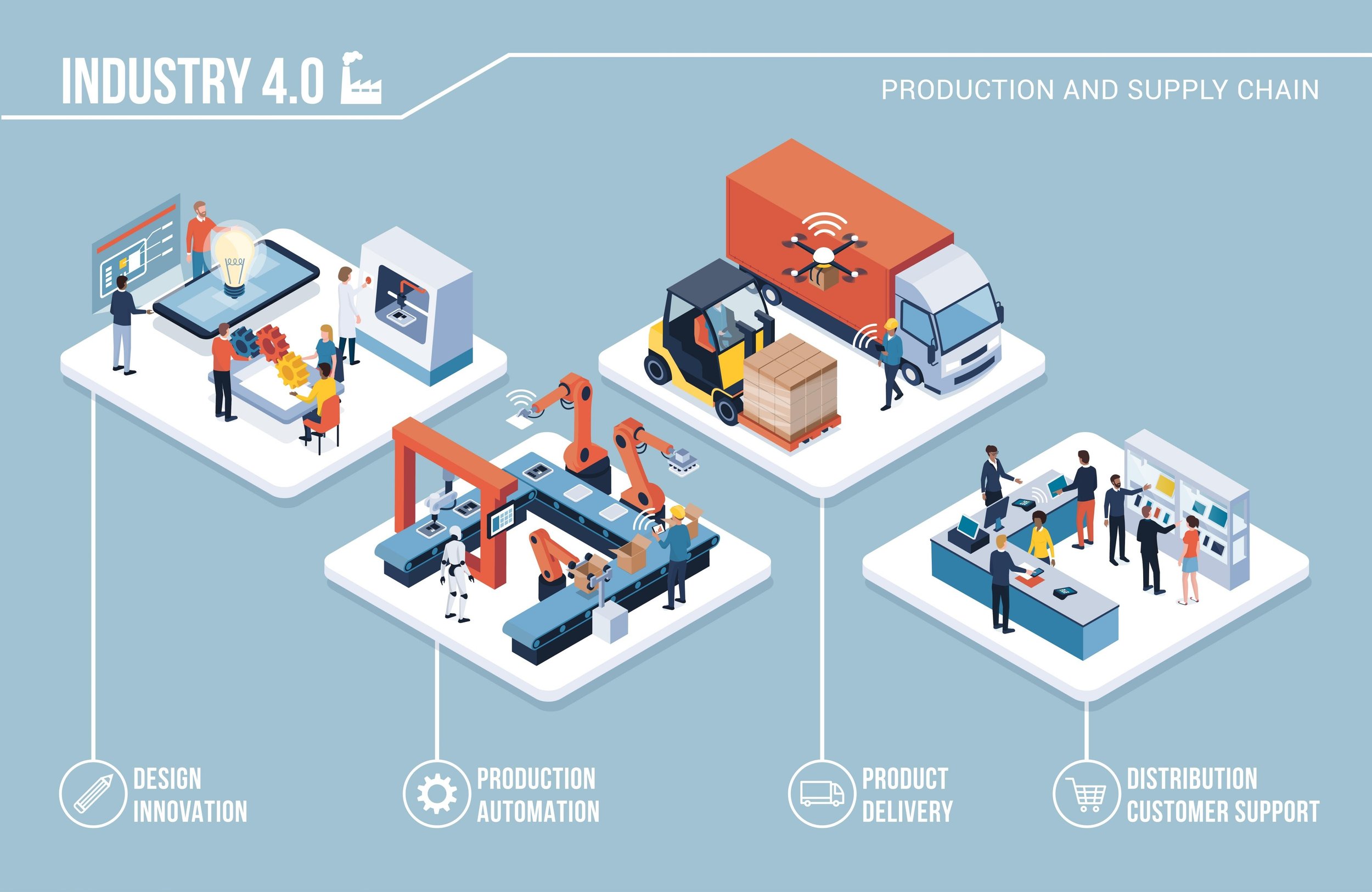

In the lower-middle market, a business is more than the sum of its machinery; it is a vehicle for wealth preservation. As we navigate 2026, the industrial landscape is being reshaped by sophisticated automation and the aggressive reconfiguration of global supply chains.

For the owner of a manufacturing enterprise with $2M to $50M in revenue, these shifts are not merely operational—they are fundamental drivers of EBITDA Multiples. A business that successfully integrates Industry 4.0 standards commands a premium; one that does not risks being viewed as a distressed asset.

Staying ahead of these trends is essential for any principal considering Selling a Business. Attending key industry summits provides the market intelligence necessary to refine your Deal Structure and ensure your company is positioned as a "premium" acquisition target for private equity or strategic buyers.

For specialized industrial exits and to see how we position firms for maximum market premium, visit our dedicated division, The Precision Firm.

Top Strategic Manufacturing Forums for 2026

To achieve a successful Strategic Exit Planning outcome, one must understand where the "smart money" is flowing. The following conferences represent the highest concentration of innovation and institutional capital in North America.

IMTS 2026 – International Manufacturing Technology Show

Date: September 14–19, 2026

Location: Chicago, IL

M&A Relevance: As the premier event for advanced manufacturing technology, IMTS is where owners can benchmark their technological moat. Buyers prioritize firms with integrated digital twins and additive capabilities, as these reduce post-close integration risks.

Strategic Value: Assessing how your current CAPEX investments align with industry standards to defend your Valuation.

AeroDef Manufacturing 2026

Date: March 2026 (TBD)

Location: Long Beach, CA

M&A Relevance: Aerospace and Defense remain high-multiple sectors due to long-term contracts and high barriers to entry. This event is critical for understanding the "Cyber-Secure" requirements that now dictate the eligibility of a firm for acquisition by Tier-1 defense contractors.

Specialized Insight: For specialized industrial exits in high-spec environments, visit our dedicated division via The Precision Firm.

The Manufacturing Summit (NAM)

Date: Spring 2026 (TBD)

Location: Washington, DC

M&A Relevance: This is a policy-heavy environment where the "Chairman’s View" is most vital. Understanding the regulatory trajectory and economic outlook is paramount when determining the optimal timing to Sell.

Strategic Value: High-level networking with policymakers and CEOs to gauge the macroeconomic headwinds affecting Middle Market M&A.

FABTECH 2026

Date: November 2026

Location: Las Vegas, NV

M&A Relevance: FABTECH highlights the transition from manual labor to robotics. In a tight labor market, a business that has successfully automated its welding and fabrication processes will command a significantly higher multiple than its labor-dependent peers.

Strategic Value: Identifying automation partners that can enhance your firm’s scalability prior to an exit.

Smart Manufacturing Experience

Date: June 2026

Location: Pittsburgh, PA

M&A Relevance: This forum focuses on IIoT and AI integration. From a Deal Structure perspective, proprietary data collection processes can often be carved out or used as a lever for a higher "Blue Sky" valuation during negotiations.

Strategic Value: Converting raw production data into a strategic asset that attracts sophisticated private equity groups.

Maximizing Value Through Market Intelligence

The decision to transition out of a business is the most significant financial event in an owner's life. Success is rarely a matter of luck; it is the result of meticulous preparation and an intimate understanding of market timing.

Benchmarking EBITDA Multiples: Use these events to see which technologies are becoming "standard." If your firm lags behind, your multiple will suffer.

Strategic Buyer Identification: Observe which corporations are expanding their footprint. These are your potential acquirers.

Wealth Preservation: Understanding the future of the industry allows you to exit at the peak of the cycle rather than during a plateau.

If you are evaluating your position in the current market, a Strategic Consultation can provide the clarity needed to move forward with confidence. Contact Us today.

FAQ / Strategic Recap

How do current manufacturing trends impact EBITDA multiples in the middle market? Multiples are increasingly bifurcated. Companies that have successfully implemented Industry 4.0—such as AI-driven predictive maintenance and robotics—often see a 1-2x turn premium over traditional "job shops" due to increased scalability and reduced reliance on a shrinking skilled labor pool.

What is the most important factor in a deal structure for a manufacturing exit? For most owners, the balance between "Cash at Close" and "Rollover Equity" is paramount. In a growth-oriented sector, retaining 10-20% equity can allow the seller to participate in a "second bite of the apple" when a private equity partner further scales the business.

When should I begin strategic exit planning for my manufacturing firm? Ideally, the process should begin 24 to 36 months before a desired exit. This window allows for "window dressing" the financials, optimizing the management team, and making strategic CAPEX investments that will be fully reflected in the final purchase price.